Not known Facts About Stonewell Bookkeeping

Rumored Buzz on Stonewell Bookkeeping

Table of ContentsOur Stonewell Bookkeeping PDFsThe Greatest Guide To Stonewell BookkeepingThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe Greatest Guide To Stonewell BookkeepingEverything about Stonewell Bookkeeping

Most lately, it's the Making Tax Obligation Digital (MTD) effort with which the government is expecting businesses to conform. Accounting. It's specifically what it says on the tin - services will certainly need to begin doing their taxes digitally with making use of applications and software program. In this case, you'll not only require to do your publications but likewise make use of an app for it.You can rest very easy recognizing that your business' monetary details prepares to be reviewed without HMRC giving you any anxiousness. Your mind will be at ease and you can focus on other locations of your business. No matter if you're a full newbie or a bookkeeping expert. Doing electronic bookkeeping offers you lots of opportunities to learn and fill out some understanding spaces.

Stonewell Bookkeeping Can Be Fun For Anyone

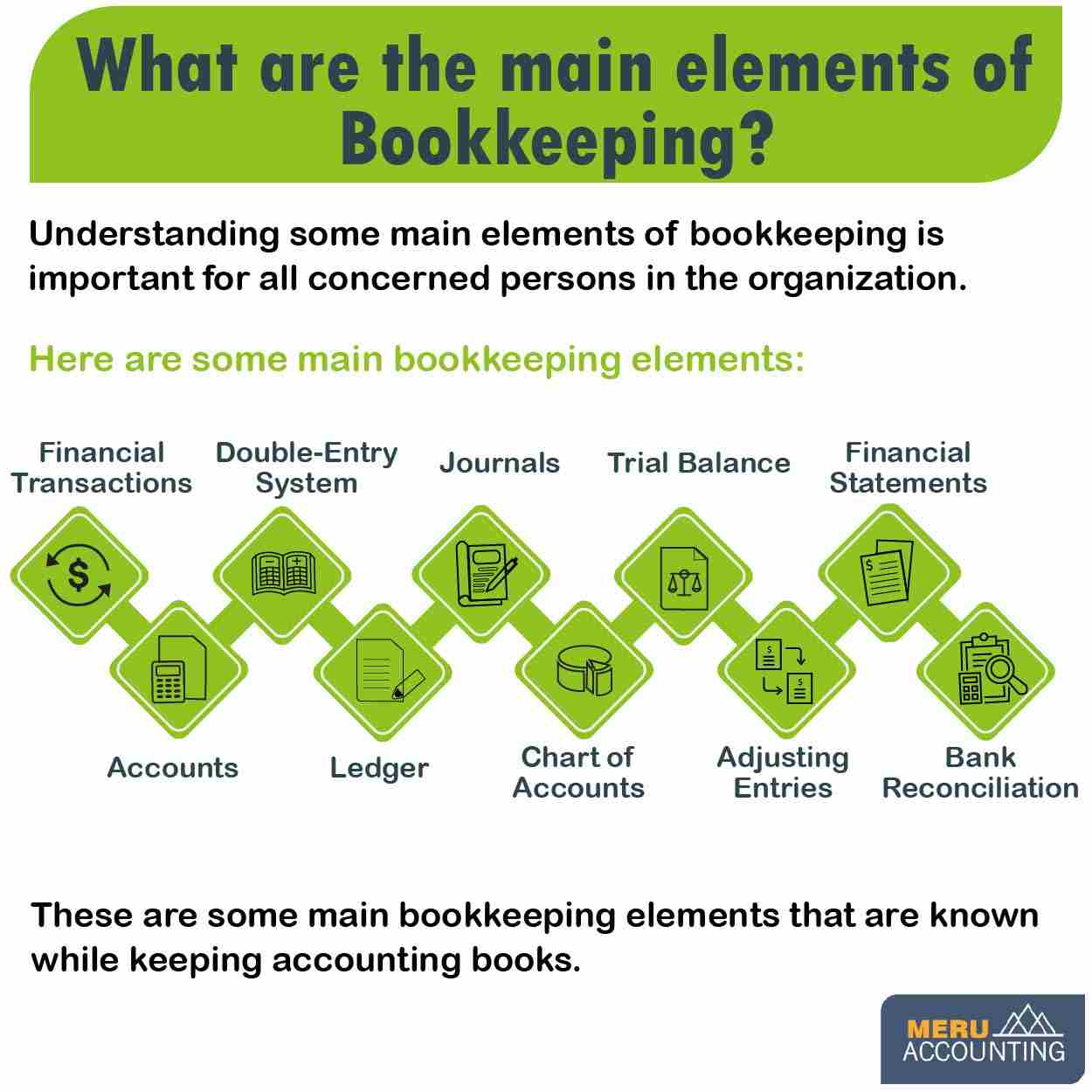

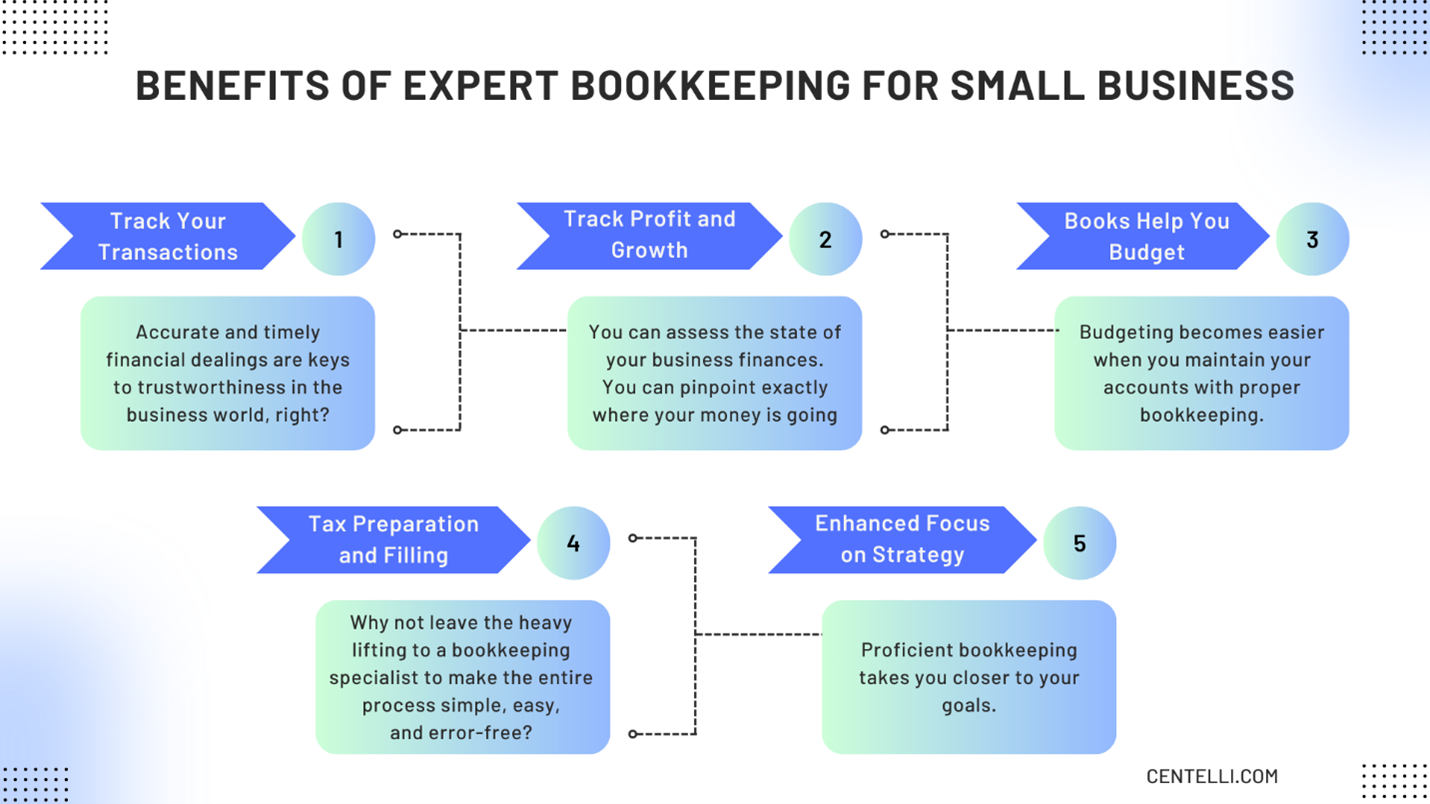

Accounting is necessary for a tiny company as it aids: Display economic health and make notified decisions, including money circulation. Mobile accountancy applications offer a number of benefits for little organization proprietors and entrepreneurs, simplifying their monetary administration tasks (https://www.tumblr.com/hirestonewell/803084772714872832/stonewell-bookkeeping-group-provides-expert?source=share).

Many modern bookkeeping applications enable users to connect their savings account directly and sync the deals in actual time. This makes it less complicated to keep track of and track the income and costs of the organization, eliminating the demand for hand-operated entry. Automated functions like invoicing, expenditure tracking, and importing bank transactions and bank feeds conserve time by lowering hand-operated data entrance and streamlining accountancy procedures.

Furthermore, these applications reduce the demand for hiring added staff, as several tasks can be taken care of internal. By leveraging these benefits, little company owners can enhance their monetary administration processes, enhance decision-making, and focus a lot more on their core service operations. Xero is a cloud-based audit software that aids small companies conveniently manage their audit documents.

when you're choosing based on guesswork instead of data. That "rewarding" client may in fact be costing you money as soon as you consider all costs. That task you believed was damaging also? It's been haemorrhaging cash money for months, but you had no other way of recognizing. The Australian Taxation Office doesn't mess around, either.

What Does Stonewell Bookkeeping Do?

Below's where accounting comes to be truly amazing (yes, truly). Accurate monetary records provide the roadmap for company growth. Accounting. Firms that outsource their accounting mature to 30% faster than those handling their very own publications internally. Why? Due to the fact that they're choosing based on strong data, not estimates. Your bookkeeping reveals which solutions or items are really profitable, which clients are worth maintaining, and view it now where you're investing needlessly.

Currently,, and in some capacity. Yet even if you can do something doesn't mean you should. Here's a useful comparison to help you determine: FactorDIY BookkeepingProfessional BookkeepingCostSoftware costs just (cheaper upfront)Service charge (normally $500-2,000+ regular monthly)Time Investment5-20+ hours per monthMinimal testimonial records onlyAccuracyHigher error danger without trainingProfessional accuracy and expertiseComplianceSelf-managed risk of missing out on requirementsGuaranteed ATO complianceGrowth PotentialLimited by your offered timeEnables concentrate on core businessTax OptimisationMay miss reductions and opportunitiesStrategic tax obligation planning includedScalabilityBecomes frustrating as service growsEasily scales with service needsPeace of MindConstant bother with accuracyProfessional guarantee If any of these noise acquainted, it's probably time to bring in a specialist: Your organization is growing and purchases are multiplying Accounting takes greater than 5 hours weekly You're registered for GST and lodging quarterly BAS You use personnel and manage payroll You have numerous earnings streams or savings account Tax obligation period loads you with authentic dread You would certainly rather focus on your actual innovative job The truth?, and specialist bookkeepers understand how to utilize these tools effectively.

The Facts About Stonewell Bookkeeping Uncovered

Perhaps specific jobs have better repayment patterns than others. Also if selling your service appears distant, maintaining clean monetary records constructs venture value.

You could additionally overpay tax obligations without proper documentation of reductions, or face troubles throughout audits. If you uncover errors, it's important to fix them promptly and modify any kind of affected tax obligation lodgements. This is where specialist accountants prove vital they have systems to capture mistakes before they end up being expensive issues.

At its core, the major distinction is what they finish with your monetary data: take care of the daily tasks, consisting of recording sales, expenses, and bank reconciliations, while keeping your basic journal as much as date and accurate. It has to do with obtaining the numbers appropriate consistently. action in to evaluate: they look at those numbers, prepare monetary declarations, and interpret what the information actually indicates for your organization growth, tax setting, and productivity.

The smart Trick of Stonewell Bookkeeping That Nobody is Talking About

Your business decisions are only comparable to the documents you have on hand. It can be difficult for entrepreneur to independently track every cost, loss, and profit. Preserving exact documents calls for a whole lot of work, also for local business. For instance, do you recognize just how much your company has invested in pay-roll this year? Exactly how around the amount invested on stock thus far this year? Do you know where all your receipts are? Company taxes are intricate, time-consuming, and can be difficult when trying to do them alone.